Getting Started with Taxes

Taxing within the EasyCart

You may not know it, but the EasyCart is a very powerful system when it comes to getting taxation correct for your store. We offer six different ways to tax your customers, ways to allow users to be tax exempt, and all the tools you need to operate within the laws in your situation. For this article we will cover our largest customer bases (USA, Canada, EU, and Australia) and give tips on how to operate within the laws most easily.

USA?Taxation

Businesses based in the USA have it easy, if you have a physical presence in a state, collect applicable local and state sales tax. If you have multiple physical locations in multiple states, then you must collect the tax applicable to each state that you have a physical presence. In addition, you only have to charge that sales tax to purchases that?ship?to?states you plan to tax, for example: No need to tax someone from Arizona if your business is located in Washington. Lately we have had?a lot of questions in regards to taxing each state you sell to, regardless of the location, but this is simply not true at this time. We happily point you to an article on the SBA’s website, which quickly confirms the small amount needed for most small businesses; to read more on this topic:?https://www.sba.gov/content/collecting-sales-tax-over-internet.

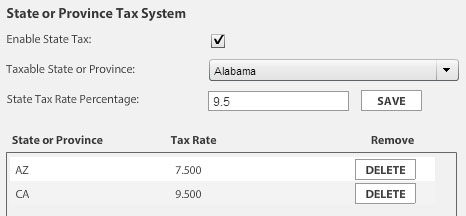

Setting up sales tax is simple for many operating in the USA (we will cover the exception next). Go to your WordPress admin and go to EasyCart Admin -> Store Admin -> Rates -> Manage Taxes to begin setting up. First select “Enable State Tax”, then, for each state you need to tax within, select the state and enter a tax rate (e.g. 8.5) and click save.

[divider]

As mentioned above, there is a small exception to the rule of thumb that tax in the USA is easy for online sales. If you have lots of physical locations across a state that has different local tax rules, you are theoretically supposed to charge a sale from each area in the state a different amount. Luckily, a wonderful tool is available and already integrated for use within the WP EasyCart, Tax Cloud! Tax Cloud allows you to setup a free account and establish the necessary tax rules by cities, counties, and states, making the process of taxing the correct amount easy! For more information on integration with Tax Cloud, we refer you to our docs on the topic:?http://wpeasycart.com/docs/3.0.0/settings/advanced_options.php#taxcloud.

Canada Taxation

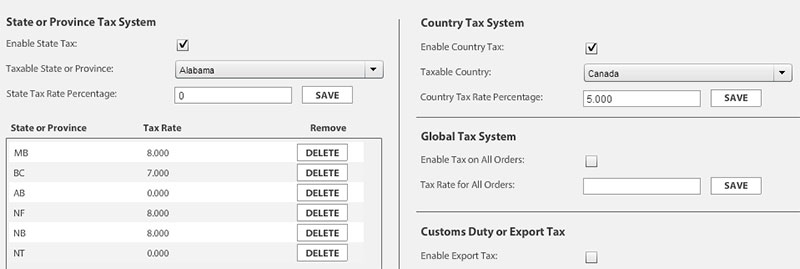

Tax in Canada consists of GST, HST, and PST, which makes setting up slightly more complicated than setting up in the USA, but never-the-less a fairly simple process once you know which options to select. The first step is to go to the WordPress admin -> EasyCart admin -> Store Admin -> Rates -> Manage Tax Rates and enable the country tax system and add a 5.00% tax for Canada. Then move over and enable the state tax system and add the appropriate tax rates for each province/territory, if you are unsure of these rates, you can find the exact rates on?http://en.wikipedia.org/wiki/Sales_taxes_in_Canada.

EU Taxation (VAT)

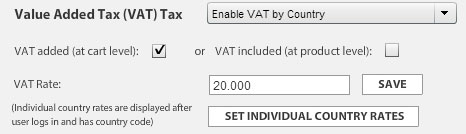

We have now come to the most complicated taxation system around and because of this we offer the most options for our EU customers. Start by navigating to your WordPress Admin -> EasyCart Admin -> Store Admin -> Rates -> Manage Tax Rates. The first choice is do you want to charge VAT at a specific rate globally or different rates for each country. The latest VAT laws require you to charge VAT in the country that you ship to, so our recommendation is to go straight to the country to country rates. The next choice?is between including VAT?in the price of the product or adding VAT to the order totals during checkout and this varies from country to country so choose the method best for you, but if you choose to include VAT in the product pricing remember to set your pricing to include your countries base rate, the cart will adjust from there for each country.

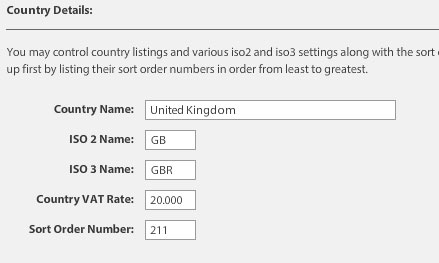

Now that you have the basics setup we should move to adding individual country rates. If you are on the screen shown above, click the set individual country rates button, otherwise navigate to EasyCart Admin -> Store Admin -> Settings -> Manage Country List and edit each country that you plan to sell to. A complete list of rates is available here:?http://en.wikipedia.org/wiki/Tax_rates_of_Europe.

At this point you should be taxing your customers correctly according to the EU rules, but in order to be in complete compliance you will need to do a few more things to really be ready to sell. The first requirement of 2015 is that you must require your customers to confirm that they are providing accurate information as to the shipping location. To do this, first turn on the requirement that the customer agree to your terms and conditions in the WordPress Admin -> EasyCart Admin -> Store Setup -> Basic Settings and in the cart section turn on “Require Terms Agreement”. You should also add links to your terms and conditions in the basic settings while you are there, which should be a separate page on your website. Edit the agreement text in the?WordPress Admin -> EasyCart Admin -> Store Setup -> Advanced Language in the section “Cart – Payment Information”, edit the terms text to fit your specific requirements.

The final thing to know is that you are required to collect and save evidence of the customer, including the purchaser’s IP Address and proof they agreed to your terms (which should now include information about how they agree they are shipping to the intended country, even if their IP Address is outside the country). We collect this for you and can be downloaded from the?WordPress Admin -> EasyCart Admin -> Store Admin -> Orders -> Store Orders -> Export Orders. You will find this information at the far right of the downloaded excel file.

Australia Taxation (GST)

By far the easiest setup is for Australia, go to your WordPress Admin -> EasyCart Admin -> Store Admin -> Rates -> Manage Tax Rates and enable VAT tax by country with VAT included at the product level and the VAT Rate a general 10% tax. Once you save this, set the individual country rates and set Australia to 10%. This should make your store compatible by law.

To adjust the wording on the store and fix the VAT display to say GST, go to the?WordPress Admin -> EasyCart Admin -> Store Setup -> Advanced Language and edit the content to switch VAT to GST.

Other Great Options

1. Product taxation on/off – To turn tax on or off for each product, simply go into the advanced listing options while creating the product and check/uncheck the VAT option.

2. User Tax Exemption – You can allow specific users to be tax exempt by going to the user’s account in the store admin -> accounts area and?check the “Exclude Taxes” box.

3. VAT included/excluded from shipping – By default, VAT is added to the total including shipping, to disable this option go to?WordPress Admin -> EasyCart Admin -> Store Setup -> Advanced Options and turn on “No VAT For Shipping”.